Your Investment Options & Investment Pool Performance

Invest your charitable assets to meet your charitable goals.

The Greater Kansas City Community Foundation's investment program offers the flexibility to customize how your charitable assets are invested to meet your charitable goals.

There are three ways to participate.

Option 1: Have Your Trusted Financial Advisor Manage Your Fund

If your fund's assets will exceed $100,000, you can benefit from custom investment management by an advisor you already know and trust. If this option is right for you, simply put us in touch with your financial advisor and our team will take care of the rest.

Option 2: Select an Investment Mix Using the Community Foundation's Investment Pools

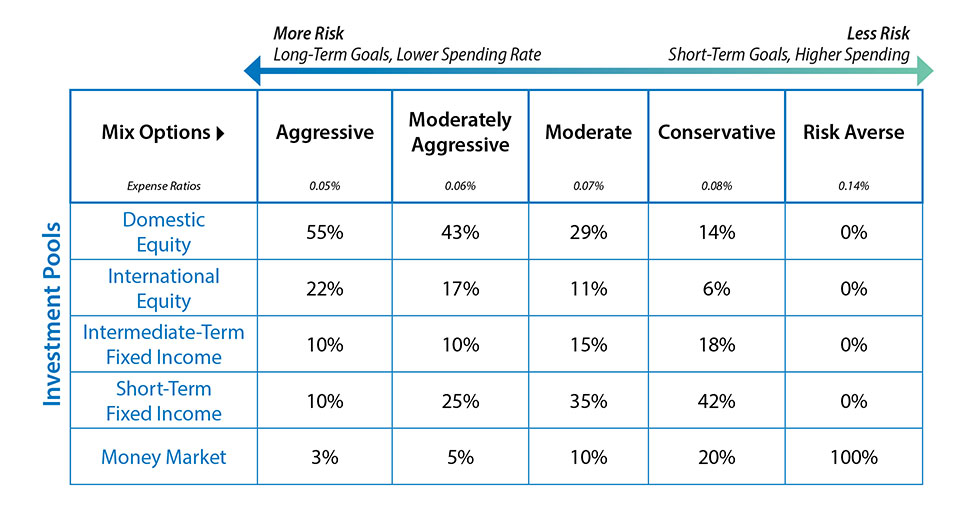

The Community Foundation’s investment pools allow you to match your investment strategy with your risk tolerance and long-term objectives for your fund. The pools are organized according to asset class and include the following: Domestic Equity (100% U.S. Stock), International Equity (100% Foreign Stock: 80% Developed Markets and 20% Emerging Markets), Intermediate-Term Fixed Income, Short-Term Fixed Income, and Money Market (Liquidity Account).

You can select a mix from the options listed below, or create your own custom mix.

Option 3: Select an Investment Mix Using the Community Foundation's Investment Pools with an Emphasis on Environmental, Social and Governance (ESG) Factors

In addition to the pools listed above, you can choose from three ESG pools that are made up of passive equity investments.

- The Social Impact Pool (70% U.S. Stock and 30% Foreign Stock) invests in organizations that are treating employees and customers fairly and are creating opportunities for the least advantaged. Additionally, the Pool focuses on investment managers from groups that have been traditionally excluded from the asset management industry.

- The Environmental Impact Pool (70% U.S. Stock and 30% Foreign Stock) invests in organizations that are best positioned to address and cope with rising climate risks by reducing carbon emissions, conserving resources, and adopting environmental policies.

- The Broad ESG Impact Pool (70% U.S. Stock and 30% Foreign Stock) invests in organizations that tackle global challenges through commitments to environmental action, diversity and inclusion, and good governance.

Want to learn more?

Select or Change Your Investments

There are two ways to change your investment options:

- Log in to the online portal and visit the "Investments" tab.

- Download and complete the Investment Recommendation Form PDF and return to Donor Services at service@growyourgiving.org or fax 816.842.8079.

Investments are adjusted monthly, and changes are applied on the last day of each month. Changes submitted during or after the last full week of each month will be effective on the last day of the following month.

Investment Performance

The responsibility for managing the Community Foundation's investment program is vested in our Board of Directors through the Investment Committee. This committee works closely with staff and the Community Foundation's investment advisors to set policy, establish performance benchmarks and monitor performance. The investment pool percentages in the mix options may change from time to time upon Investment Committee review.

For recent investment performance reports, click to download the following PDFs. The investment performance summaries are updated monthly, and the investment performance supplemental report is updated quarterly.

Monthly Investment Performance Reports:

Investment Performance Summary - June 2024

ESG Investment Performance Summary - June 2024

Quarterly Investment Performance Supplemental Reports:

Investment Performance Supplemental Report - 2nd Quarter 2024

ESG Investment Performance Supplemental Report - 2nd Quarter 2024