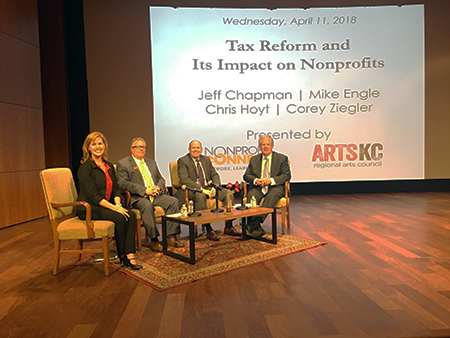

Corey Ziegler, Greater Kansas City Community Foundation Vice President and Corporate Counsel, recently sat on a panel hosted by Nonprofit Connect and ArtsKC to discuss the Tax Cuts and Jobs Act and how it impacts local nonprofit organizations.

Corey was joined by three other local professionals well-versed in the latest tax reform. Chris Hoyt, Professor of Law at UMKC School of Law, led the panel and served as moderator. Mike Engle, Partner at BKD and Jeffrey Chapman, Assistant Vice President of the UMKC Foundation also sat on the panel.

Members of the audience, mostly representing local Kansas City public charities, have concerns regarding how the Tax Cuts and Jobs Act will affect them – and the donors they depend on.

With the increase in the standard deduction, the number of individual donors who itemize their deductions will likely decrease in 2018 – from 47 million to 19 million. The number of taxpayers who deduct charitable gifts is expected to fall from 36 million to 16 million.

While this is concerning to nonprofits who rely on consistent charitable contributions, Corey and the other panelists offered up a potential solution and some reassuring advice.

“Donors are giving because they care about nonprofits, their mission and their values,” Corey says. “Regardless of the changes in tax law, donors will always find a way to give to the organizations near and dear to their hearts.”

Corey shared that the Community Foundation saw a record number of donor-advised funds established in the final days of 2017. This suggests that donors are forward-thinking and, with some planning and strategy, they can continue to support nonprofits and still receive the tax benefits.

A tax strategy known as bunching, paired with a donor-advised fund, can help donors consistently support their favorite charities. Donors can combine two or three years of charitable contributions into their donor-advised fund in one year to exceed the standard deduction and then use those assets to grant dollars to charities at any time – even in years when they take the standard deduction.

Bunching, also known as leapfrogging, clumping, or looping, is beneficial for the donor and for the charities that they support. Without a donor-advised fund, an individual or couple would likely have to make a large, lump-sum donation to a charity every few years, leaving the charity without those funds they previously received annually.

While the Tax Cuts and Jobs Act may be viewed as an obstacle for nonprofits, the panelists emphasized that now is an important time to tell their organizations’ stories. The tax benefit a donor receives from a charitable contribution will never outweigh the emotional benefit they receive when their personal values align with the mission, goals and passions of the nonprofits they support.

The Community Foundation does not provide tax, legal or accounting advice. You should, of course, work closely with your individual financial advisor and tax professional to determine how you can continue financially supporting nonprofits while maximizing your giving with a donor-advised fund.

Authored by: Ashley Hawkins, Content Specialist